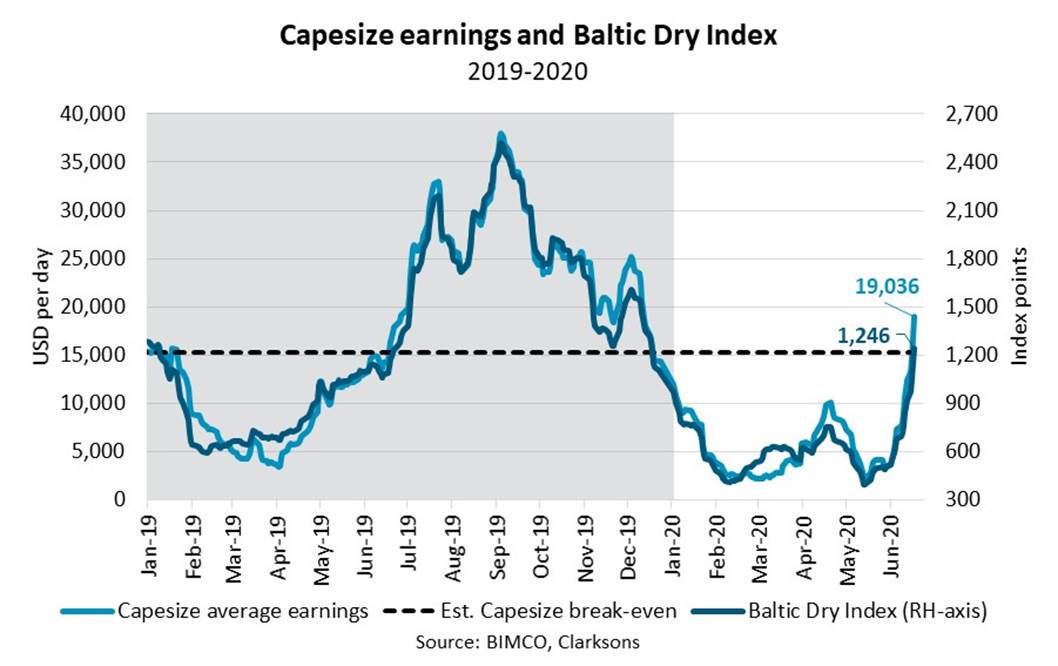

On 17 June 2020, the Capesize average earnings jumped a staggering USD 4,250 per day, the largest daily gain since 2013, settling at USD 19,036 per day. Capesize average earnings have rallied in recent weeks, but Wednesday’s observation marks the first time in 2020 that average earnings have risen above the estimated break-even level.

For now, volatility appears to be back at full scale with earnings gaining just USD 9,894 per day in a single week. The jump in earnings stands in stark contrast to the USD 4,042 average in May, levels at which Capesize shipowners on average lost more than USD 10,000 per day.

The development is graciously welcomed in a market where the first half of 2020 has turned out to be one of the most challenging periods in recent years. The rising tide is mirrored in the Baltic Dry Index, the headline dry bulk indicator, which has also recently broken through the 1,000 index point mark, settling at 1,246 index points on 17 June 2020, up 482 index points from last week.

Blasting beyond break-even

The Capesize market has endured extreme hardship through the first five months of 2020 with rates lingering well below break-even levels. With the Covid-19 pandemic eclipsing the global economy in uncertainty, the seasonal downturn in the first quarter was seemingly exacerbated till early June.

However, the previous week has marked a substantial reversal and pulled Capesize back from the brink with average earnings finally hovering in positive territory. The jury is still out as to whether this leap in earnings can be sustained in the coming weeks. The positive market development comes on the back of improving economic conditions in China and rising demand for iron ore, as well as improving market sentiment in line with usual seasonality.

A lasting Capesize comeback?

Granted the increasingly lacklustre trade growth forecasts for 2020, with the latest one from the World Bank projecting a 13.4% drop in world trade volumes, it remains hard to envision that dry bulk earnings can surge to levels that will recoup the losses of the first half of 2020. Nonetheless, it is still early days in the Capesize comeback, and the past has taught us that sentiment should never be underestimated.

In some corners of the market, Chinese economic stimulus is anticipated to be the saving grace for the dry bulk market in the second half of 2020. However, as BIMCO has noted, there are several structural factors which will limit the knock-on effect of Chinese stimulus packages on the dry bulk market.

To finish off on a more positive note, the rise in Capesize earnings provides a glimmer of hope amidst the bleak dry bulk market conditions that have prevailed in the first half of 2020 and underscores that market volatility has not been banished by the Covid-19 pandemic.