|

Ocnus.Net Business The copper price declined again on Monday as markets in China, responsible for more than 50% of the world’s copper consumption, reopened to deep losses after an extended halt to trading due to the coronavirus outbreak. Thirteen consecutive down days in New York saw copper for delivery in March pushed down 14% in value, last trading at $2.4875 a pound ($5,485 a tonne) on the Comex market in New York. Volumes were massive, with the equivalent of 3.1 billion pounds of copper (1.4m tonnes) traded by mid-afternoon on Monday. If the metal closes below $2.50 it would be the lowest level since mid-May 2017.

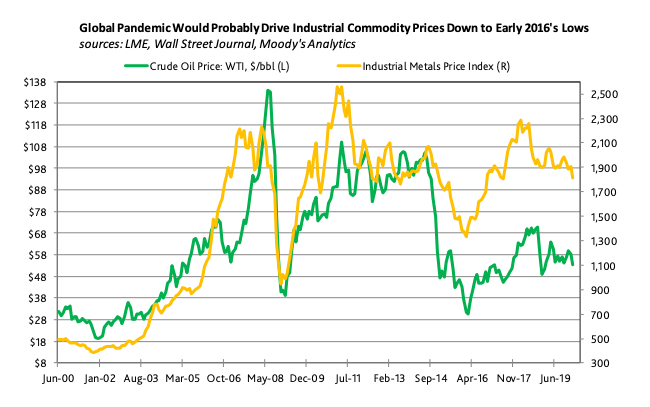

Unlike the financial crisis, public-health and economic policymakers may be limited regarding their ability to remedy or offset a 1918 (or Spanish flu) type pandemic

In a research note, Moody’s Capital Markets Research chief economist John Lonski said that a coronavirus pandemic (and the declaration of the outbreak as such seems imminent) would be a “black swan like no other.”

Moody’s says due to the outsize role of China in global industrial activity and the sluggishness evident in the base metals complex even before the outbreak, the impact of a full-blown pandemic would be considerable.

Copper prices bottomed at $1.94 a pound in January 2016 and averaged $2.21 for the year, the lowest annual average price since 2005. Zinc price fell to a low of $1,453 a tonne that same month while nickel’s lowest point came in February of 2016 at $7,725 a tonne. Source: Ocnus.net 2020 |