Karpowership ASA, the Turkish-led consortium tipped as a preferred bidder for an estimated R225-billion energy deal, was dealt an extraordinary series of aces during the tender process.

These trump cards allowed Karpowership to emerge as the single largest beneficiary of the government’s Risk Mitigation Independent Power Producer Procurement Programme (RMI4P) — and lie at the heart of industry disquiet and the court challenge being mounted by losing bidder DNG Energy.

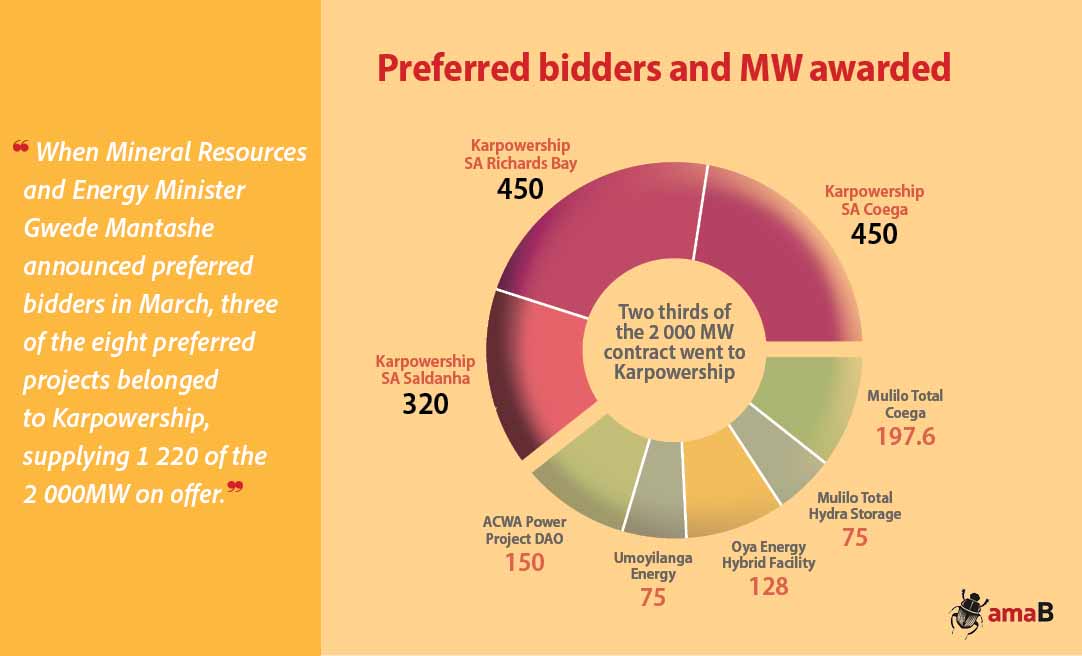

When Mineral Resources and Energy Minister Gwede Mantashe announced preferred bidders in March, three of the eight preferred projects belonged to Karpowership, supplying 1,220 of the 2,000MW on offer. The projects involve five powerships being moored in the ports of Ngqura (Coega), Richards Bay and Saldanha.

Perhaps most problematically Mantashe’s department, which ran the tender, permitted temporary leases of second-hand ships to qualify as “greenfield projects” and magically meet a 40% local content threshold during “construction” despite the fact they are foreign-built.

Some in the renewable energy sector felt the RMI4P rules were rigged from the outset in favour of gas.

Participants’ confusion and exasperation were captured in periodic briefing notes the department issued throughout the tender process to answer questions, and to announce frequent changes to the rules themselves.

As the tender unfolded, some came to believe that the process was being “led” to favour just one company: “The signs of blatant tampering are everywhere,” an anonymous insider who worked on the tender told us.

And then there were those, like rival gas bidder DNG Energy, that saw “undue influence” in every stage — from how the tender was “conceptualised, researched and published”, to the concessions made as deadlines drew near.

These changes were “orchestrated… by third parties”, DNG chief executive Aldworth Mbalati alleged in an affidavit filed in court last month, “in an effort to… ‘stack the cards’ in favour of certain bidders”.

The department and Karpowership SA have defended the process to us and publicly, and are to file formal answers to Mbalati’s court claims. But an amaBhungane investigation has thrown up evidence that provides some backing for part of Mbalati’s narrative.

In the course of the RMI4P tender, express goals and rules, especially around the building of new local infrastructure, fell away or were revised in ways that appeared to undermine the original purpose of the tender, but benefited Karpowership SA.

In a written response, the department said that it was “baseless and misplaced” to suggest that the tender had been manipulated in favour of Karpowership.

“The RFP design was technology agnostic to meet system requirements as identified by [Eskom]. The RFP was not designed on the basis of any supplier requirements. The hybrid nature of the selected projects, and the competition (28 bids in total received), achieved a level playing field under the [RMI4P].”

This, in our view, is the evidence that says otherwise.

‘Greenfields’ only

One of the RMI4P’s strictest demands on bidders was that their projects be “installed on a greenfield or previously cleared brownfield site”.

Bidders could not for instance upgrade or overhaul an existing project to churn out more power but had to build entirely new capacity on empty land.

“Bidders who wish to use brownfield sites for the purposes of their Projects must ensure that the existing equipment and machinery used for the generation of electricity on the proposed Project Sites… are completely decommissioned and that a new Facility… is built on the existing site,” the department explained in one briefing note.

It added: “[F]or the avoidance of doubt, infrastructure such as roads, rail sidings, buildings and storage facilities may be retained and need not be demolished and rebuilt.”

This was a blow to companies like Ansaldo Energia, an Italian turbine maker, which had previously proposed that some of the diesel peaking plants Eskom currently uses could produce twice as much power by simply changing the turbine.

“Does [this] mean one cannot convert an existing open cycle gas plant to combined cycle? A combined cycle will increase the power generation by about 40-45% and increase the efficiency of that plant by about 50% using the same fuel,” the company’s business development manager, Wallace Manyara, asked the department.

The company had also proposed that the same plants could switch to burning liquid natural gas (LNG), which would help mitigate Eskom’s problem of burning tanker-loads of expensive, polluting diesel. But the department’s response was a firm no.

“[T]he RMIPPPP was intended to unlock new additional capacity. Existing facilities already generating power for Eskom or for own use are prohibited from participating,” the department told us.

Questioned about the logic, the department said: “The demolishing of this old existing infrastructure allows for optimal solutions where aged and ineffective technologies can be repurposed or replaced with new more efficient, cheaper and competitive technologies.”

Ironically, it added that “this approach ensures value for money and is supportive of industrialisation”.

Despite this ostensible concern for industrialisation, the department asserted that powerships are also “greenfield” developments despite being built elsewhere, moored offshore and merely leased for the duration of the 20-year power supply contract.

“Yes, they are considered greenfield as these facilities are currently not supplying power into the grid or existing at the proposed three ports,” the department said.

In response to our questions about the greenfield clause, Karpowership said: “In the same way as a new power plant is built on land, each of the ships will have a new powerplant built on the ship. As such, each Powership contains a greenfield power plant.”

In another concession, the department told bidders that support ships, known as floating storage regasification units (FSRUs), would not need to meet the greenfield test. This is despite these ships being crucial and costly components of the powership project.

“The FSRU being a brownfield plant is not prohibited,” the department confirmed in one of its briefing notes. This suits Karpowership, which will deploy three FSRUs alongside its five powerships.

The department had another rationale for the greenfield rule: It did not want to duplicate Eskom’s short-term power producer programme, which had specifically asked existing facilities to deliver more power to the grid.

On 20 April, director-general Thabo Mokoena told Parliament’s portfolio committee on minerals and energy that the two would compete: “[The short-term power producer programme] was targeted at procuring power from facilities that can add capacity quickly and cheaply through short term contracts. Accommodating for brownfields projects [in the RMI4P] would have duplicated the effort.”

But those short-term contracts were limited to just three years and never amounted to more than 200MW. Beyond this doubtful “duplication”, Eskom had specifically assured suppliers under the short-term programme that they would be allowed to bid for both programmes.

Used goods

A lack of new investment in South Africa is one thing. A lack of new investment altogether is something else.

The RMI4P allowed the use of second-hand equipment so long as it had “complete and unqualified Original Equipment Manufacturer guarantees” to present to the department.

In one briefing note, an unnamed supplier of powerships asked: “Would an existing barge mounted generating unit(s) imported from outside South Africa qualify as ‘new’ generation? (even though the equipment would be effectively second hand?)”

The answer: Yes, if you have those OEM guarantees.

According to another of the department’s briefing notes, Karpowership itself asked: “For equipment… that has already been assembled within a wider functional power generation system ready for deployment; can the company that has assembled/constructed the system be deemed to be the [original equipment manufacturer] for guarantee certification purposes?”

This seems to create the interesting situation where Karpowership wants to certify its own equipment, even if second hand. It is not clear whether the department agreed.

Asked about this, the company would only say: “All required guarantees by the program have been duly submitted by Karpowership SA”.

Tricks with local content

The RMI4P followed a series of successful tenders for renewable energy projects dating back to 2011.

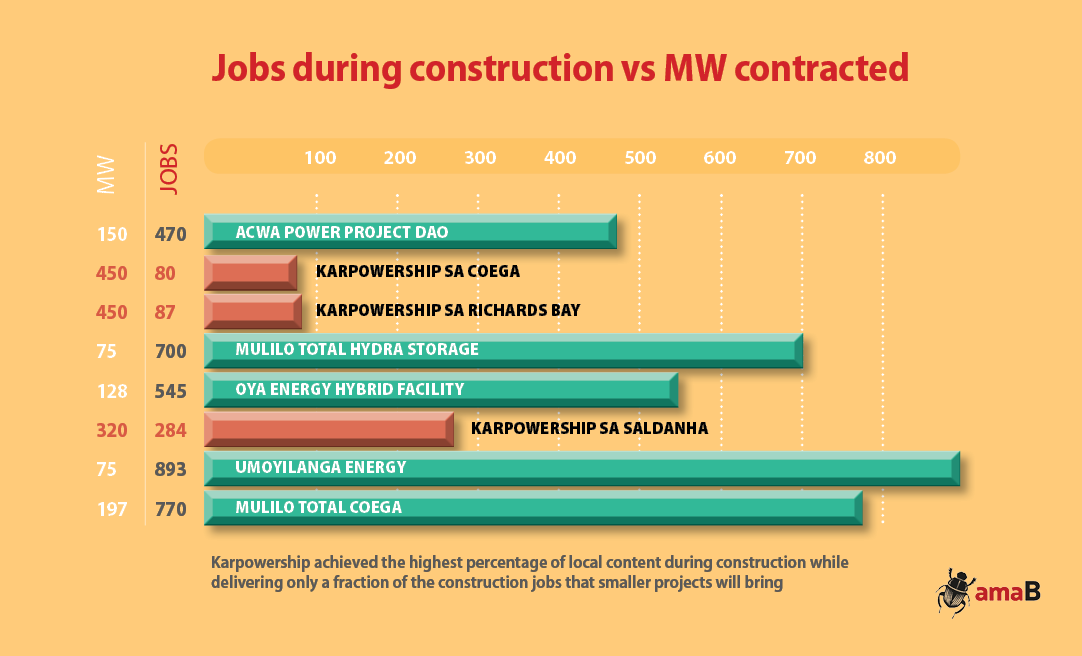

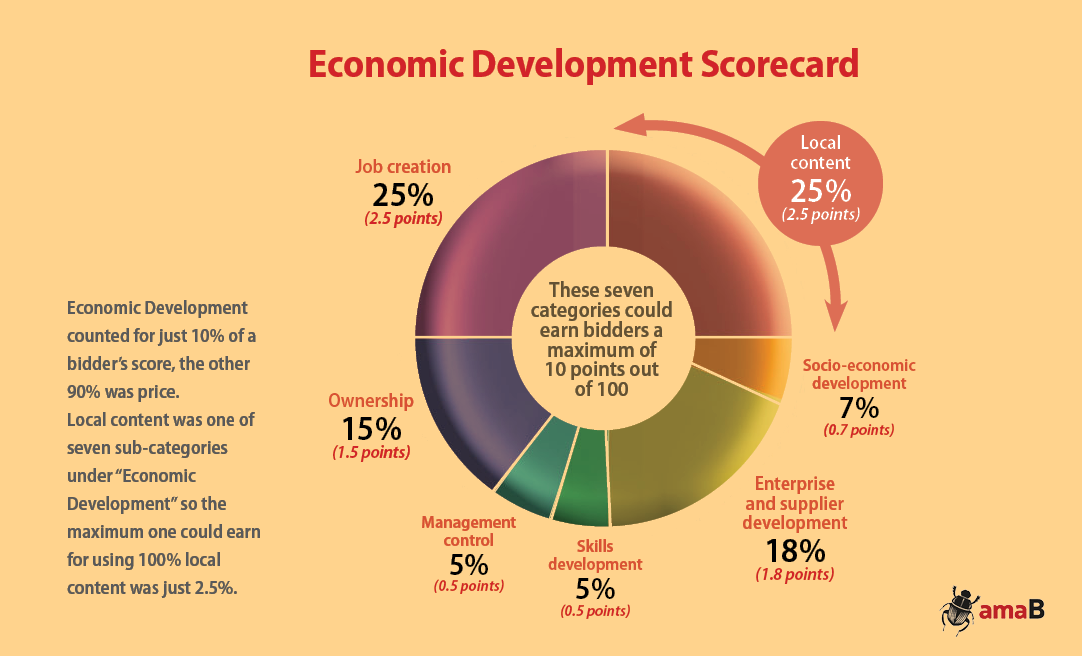

In the spirit of industrialisation, a local content requirement was put in place and progressively raised with every round of bids to reach 40% in the most recent one. Wind projects have consistently beaten the requirement and solar projects have been doing much better, achieving more than 60% local content.

The 40% requirement also applied to the RMI4P, at least on paper.

“Based on the work that the DMRE [department of mineral resources and energy] has undertaken including engagements with the Department of Trade, Industry and Competition and the market, the DMRE is satisfied that prescribed local content threshold of 40% is achievable,” the department told bidders.

How could that possibly be true of Karpowership with its fully imported ships? They will not even be owned by the local arm of the group but rather leased from an offshore arm of parent company Karpower International, as is the case with the rest of the group’s global operations.

When Mantashe announced the preferred bidders in March, he boasted: “These eight projects will inject a total private sector investment amount of R45-billion to the South African economy, with an average local content of 50% during the construction period.“

When we asked the department for a breakdown of these figures it responded that they “should in no way be presented as final” because value-for-money negotiations were ongoing.

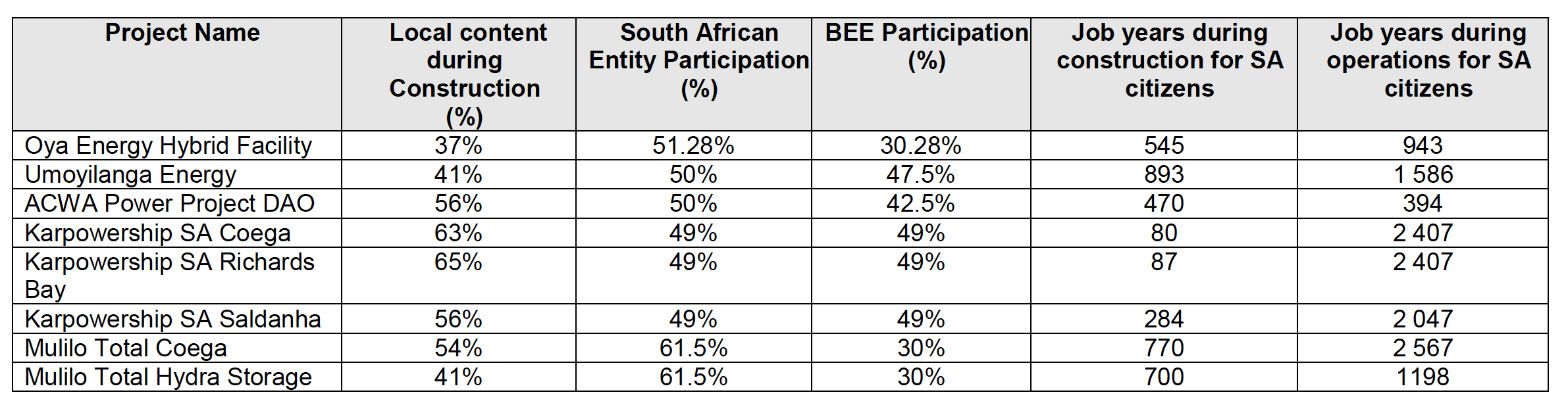

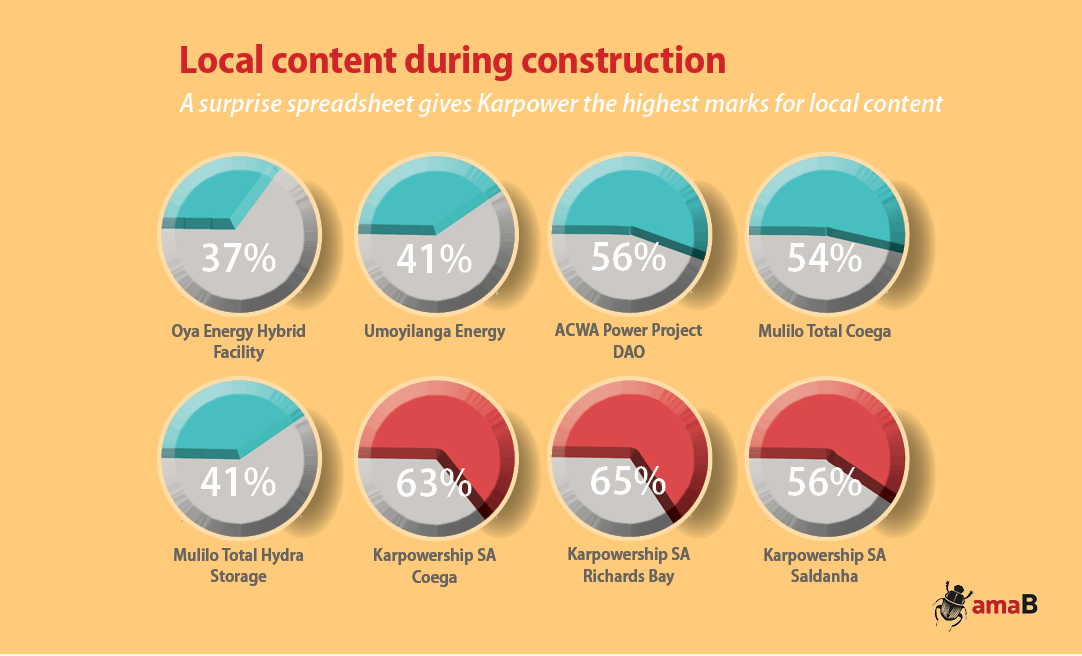

The department did provide us with a spreadsheet showing that Karpowership is promising an astonishing 65% local content during construction of its Richards Bay project, 63% in Ngqura (Coega) and 56% in Saldanha, giving it the highest local content of any of the preferred bidders.

To explain how this is possible, we must first turn to the department of trade, industry and competition (DTIC).

The tender allowed bidders to approach the DTIC to apply for an exemption if a certain piece of equipment could not be manufactured locally. Once granted, the bidder could remove that item from the “total project cost”, which is the figure that would be used to calculate local content for the purposes of the 40% hurdle.

So, if your project cost R1-billion and the DTIC gave you a R500-million exemption, you are left with a local content requirement totalling 40% of the remaining amount: R200-million in our hypothetical example.

On 4 November last year, the DTIC granted two unusual exemptions to Karpowership: One for the 300m-long Khan powership, and one for the 240m Shark powership.

Normally these would be considered “working vessels” which are subject to local manufacturing requirements. The DTIC excluded the ships in totality with the proviso “that the engineering, maintenance, repair and overhaul services are done locally”.

It is unusual for the DTIC to grant exemptions to one company for what is effectively its whole branded system. Normally the DTIC would grant an exemption on a specific component, but in this case the exemption would apply to the entire ship, regardless of whether components of the ship could be sourced locally or not.

Once the powerships themselves are removed from the “total project cost”, all that is left to build locally are the transmission lines, gas pipelines and minor local infrastructure. This will amount to R645-million spent on local content during construction at its three sites, according to Karpowership.

It is hard to square this figure with Mantashe’s supposed R45-billion investment, considering that Karpowership SA’s projects comprise most of the RMI4P.

It does however explain how the bid achieved the highest percentage of local content during construction while delivering only a fraction of the construction jobs (and presumably expenditure) that smaller projects will bring.

Asked why it had given such sweeping exemptions to Karpowership, the DTIC told us that it considered two facts: “that the South African boat building industry does not manufacture powerships” and that South Africa “has no manufacturing facilities to accommodate ships of the prescribed dimensions (currently capacity is limited to 100m)”.

This was confirmed in letters from manufacturers SA Shipyards and OSC Marine Africa.

Based on this, “the DTIC could not refuse to grant the request,” spokesperson Sidwell Medupe said.

Zero incentive

Karpowership may very well have avoided disqualification by getting the DTIC exemption, but that did not mean local content was completely irrelevant. Or did it?

The RMI4P, at least in its initial form, applied the 40% threshold in the first stage of the tender, where contenders that did not meet set criteria, local content included, were weeded out.

Then it entered an evaluation phase where exemptions like Karpowership’s would be irrelevant as bidders would be weighed against one another based on, among other things, the actual rand value of their local spend. On this basis, Karpowership could only ever compare badly.

But fortunately for it, the RMI4P had broken decisively from all the previous rounds of renewable power procurement from private producers. In all of those, price counted for 70% of the weight of a bid while “economic development” measures made up 30%.

In the RMI4P this reverted to the standard 90:10 ratio most government procurement employs. The result: a bidder providing precious little investment or jobs would suffer very little disadvantage.

Local content was one of seven sub-categories under “economic development” — the others were job creation, ownership, management control, skills development, enterprise and supplier development, and socioeconomic development — so the maximum one could earn for using 100% local content was just 2.5%.

Asked whether Karpowership’s bid undermined the RMI4P’s goal of building local industry, the department said that “aspects such as localisation were important, but not the main drivers of the programme.”

Under the previous power procurement programmes that would have been 7.5%, with jobs contributing another 7.5%. The difference may have thrown the outcome one way or the other.

A lawyer acting for one of the bidders pointed out: “The maximum achievable points for achieving the local content target level… are not sufficient to incentivise any increased localisation initiatives.”

Asked for comment, Karpowership said it had “delivered a bid submission that has all the necessary local content requirements”.

Shifting goalposts

While the design of the tender and the discretion exercised by the authorities gave Karpowership a boost, an equally substantial determinant of its success may have been a series of changes to the rules of the RMI4P halfway through the process.

Among these are changes being attacked by DNG Energy in court and which DNG chief executive Mbalati claims “were made at the request of and/or in a concerted effort by the [department] to assist [Karpowership] and or unduly promote the interests of [Karpowership].”

Mbalati’s argument implies that Karpowership not only knew that these changes were coming, but took advantage of them — something which he has not been able to fully substantiate in his court papers.

One “critical amendment” cited by Mbalati was a sudden deadline extension.

The tender for the RMI4P was released on 24 August with a deadline to submit a preliminary outline of one’s bid (known as a “bid notification”) by 30 October. The final bid submissions were due on 24 November. It was an incredibly tight timeframe that would by itself have caused many potential bidders to pull out of the race.

But on 30 October, the day of the first deadline, the department announced it would be moved out by a month, creating an unfair advantage for any bidders that knew about the looming extension, and in any case a potential disadvantage for bidders who by that stage had already submitted.

Mbalati claims that Karpowership not only knew about the extension in advance but that it was granted at its request. This has been strongly denied by Karpowership and by Mantashe’s wife, whom Mbalati had implicated.

In the briefing note announcing the extension, the department said it was “based on the requests submitted by potential bidders and the subsequent clarifications and changes issued by the DMRE since the release of the RFP”.

There were other changes to the rules late in the game that, in Mbalati’s words “had [a] direct and material impact on the relevant bidders’ pricing and risk”.

The department made a dramatic about-turn on whether it would allow bidders to use diesel. Initially this was prohibited but later permitted. This was done after the deadline extension and could have a decisive effect on the tariffs offered by bidders proposing renewable projects with fuel-based backups.

With diesel prohibited, one bidder we spoke to used LPG instead, leading to a substantial increase in costs and hence the tariff that they bid on. The importance of the diesel decision is further evidenced by the fact that three of the five smaller preferred bidders other than Karpowership used diesel in their projects.

Renewable bidders also saw the economics of their projects change completely halfway through the process when the department changed the “reliability run” test for projects to qualify. On 20 October, the department changed the number of days a project would have to be able to run at full tilt, without interruption, from 10 days to 15 days.

An even more substantial change is the briefing note issued on 5 December, very near the end of the process, which essentially scrapped whatever local content obligation remained.

“Having considered the market concerns, the emergency nature of the programme and in response to the queries submitted by the potential Bidders, the Department has decided to make a concession in respect of the 40% Local Content Threshold qualification criteria,” read briefing note 24.

This was from the same department which had assured bidders that it had satisfied itself that the 40% was totally achievable for all technologies.

This shift meant that in effect the 40% local content rule would disappear if a bidder could demonstrate it had to source 40% of its equipment abroad.

One unsuccessful bidder that had used more expensive local solar components told us that this shift could have allowed them to use imported ones and lower their bid price.

But at this point the final deadline was only two weeks away and it was virtually impossible to make substantive changes. This would be true of any bidder and a change to the rules this late in the game could only possibly serve to make a previously invalid bid suddenly valid, they said.

“It is crazy to think that anyone can put together a proper bid under these conditions.”

This last concession was made more than a month after the original deadline for bid notification submissions. Many potential bidders would likely have decided not to participate because they could not anticipate such a generous concession late in the game.

The department is yet to respond to Mbalati’s allegations via the court process, but it has consistently defended the RMI4P process, calling it “fair, transparent and competitive”.

“These projects will be available to generate energy output when called upon (to avoid load shedding) and provide ancillary services to reduce the significant cost of using diesel that is currently the only option available to [Eskom],” it said in its responses to us.

However, in our final analysis, the RMI4P dealt a blow to the drive towards industrialisation and green power generation. It did so through a set of changes that at times appear chaotic — and that may betray bias in favour of gas generation and Karpowership.

The ultimate price is impossible to predict with certainty as Karpowership’s tariffs hinge on international gas prices paid for in forex, and which will simply be a “pass-through” to Eskom and the electricity-using public.

The estimated R225-billion price tag could cost about the same as building the Medupi power station but leave zero investment on the ground and export most of the earnings via gas purchases — and ship leasing costs and dividends to Karpowership’s offshore parent.