Presumably induced by strong market incentives – including a healthy price spread in favour of importers and an infrastructure access reform – Chinese gas importer Foran Energy Group and US LNG player Cheniere have signed an agreement for 26 cargoes to be delivered over four years starting in 2021. Originally to a healthy start in 2018, US LNG exports to China have been hampered by a protracted trade dispute between the two countries. China has since waived tariffs on US LNG, reopening the door to US cargoes as its gas demand continues to grow. However, US foreign policy is likely to remain ‘tough on China’.

Foran Energy Group, a Chinese natural gas distribution company in the south of the country, signed a framework agreement to import LNG with US capacity developer and exporter Cheniere Energy during China’s annual trade fair in Shanghai. The American firm owns Sabine Pass LNG in Louisiana and Corpus Christi LNG in Texas. Although Cheniere has leased out the majority of its plants’ capacity to other portfolio players, it has retained a share for its own trading division.

26 cargoes over four years

The agreement between Foran and Cheniere encompasses the purchase of 26 cargoes between 2021 and 2025 and is the first term deal by a Chinese company to buy LNG from an American exporter since the Sino-US trade war disrupted deliveries in September 2018.

Trade war hampered LNG imports from US

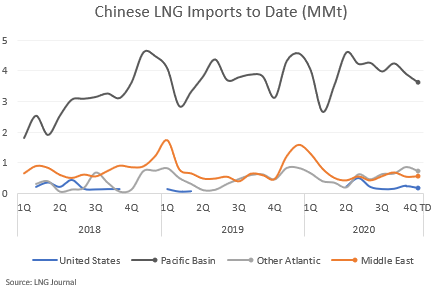

China’s LNG imports – most of which are undertaken by the country’s mammoth state-controlled energy corporations PetroChina, CNOOC and Sinopec (i.e. the ‘Big Three’) – were hampered by hefty tariffs imposed by the Chinese government in retaliation to US charges levied on Chinese goods. As a result, Chinese LNG imports stopped coming from the United States in late 2018, with only a trickle of cargoes arriving in early 2019.

Chinese LNG Imports to Date (MMt)

Chinese LNG Imports to Date (MMt)

Henry Hub linked

Foran Energy, whose operations are centred in Guangdong Province, said Cheniere’s shipments would be price-linked to the US Henry Hub benchmark, an important motivator for buying US LNG. US Henry Hub prices have to date ranged significantly lower than their oil-linked counterparts, which are typically dependent on a moving average of Brent. Abundant US gas production – in particular from the Marcellus shale gas play – in combination with a lag in the expansion of the country’s gas pipeline network is set to keep the Henry Hub index relatively low, in our view.

Tariff waivers

Earlier this year, China has introduced a roster of tariff waivers that included LNG in an effort to increase imports and supply diversity. However, China’s aforementioned state-controlled energy champions have hitherto been reluctant to enter into fresh long-term LNG agreements for US supply, presumably waiting – in line with Chinese government policy – until the Electoral College ratifies the next US president. Notably, the message from both electoral camps has been to remain ‘tough on China’.

Strong market incentives

Strong market growth for LNG in China alongside a widening gap between landed LNG and domestic gas prices is likely to have induced the Foran-Cheniere deal, in our view. The most recent available government data indicates a landed price of c. US$10.84/mmBtu with the domestic price at c. US$11.43/mmBtu in late October, resulting in a spread of around US$0.58/mmBtu in favour of LNG importers, according to our calculations. The most recent recorded domestic price stood at US$11.32/mmBtu at the time of writing.

Moreover, the Chinese government’s ‘PipeChina’ policy took effect in later October, which means smaller, independent domestic gas players now have the right to bid for third-party access to the Big Three’s pipeline and LNG terminal assets starting in November.