The market for US LNG exports have been rapidly expanding over the course of the past few months, providing ship owners with a significant new trade. In its latest weekly report, shipbroker Banchero Costa said that “on the back of booming shale gas production, the United States have now emerged as the third largest exporter of LNG in the world, coming after Qatar and Australia. Total seaborne LNG exports from the USA in the 12 months of 2019 reached 36.6 mln tonnes, +66.3% y-o-y, according to Refinitiv vessel tracking data.

Source: Banchero Costa

According to the shipbroker, “the vast majority of USA LNG exports are loaded on the Gulf coast of the country. Sabine Pass in Louisiana alone accounted for 22.9 mln tonnes in 2019 (62.8% of the country’s total). Hackberry, also in Louisiana, exported 1.6 mln tonnesin 2019. Corpus Christi in Texas accounted for 6.3 mln tonnes of export in 2019 (17.1% of the total). Freeport, also in Texas, exported 0.96 mln tonnes in 2019 On the Atlantic coast, the largest terminal is Cove Point in Maryland, which exported 4.6 mln tonnes of LNG in 2019 (12.6% of the total). In the first 6 months of 2020, the USA exported at least 24.8 mln tonnes of LNG by sea. This represents a net increase of +58.5% y-o-y, compared to the 15.7 mln tonnes exported in the same six-month period of 2019. However, the monthly trend is now turning negative. On a single-month basis, January 2020 was excellent for that time of the year, at +99.5% y-o-y from January 2019, as well as +13.8% mo-m from December 2019, at 5.0 mln tonnes”, said Banchero Costa.

Source: Banchero Costa

Meanwhile, “volumes remained very strong throughout the first quarter. In February 2020, volumes from the USA declined slightly to 4.7 mln tonnes, -6.5% m-o-m, but still +134.9% y-o-y. In March 2020, LNG loadings from American rebounded to 4.9 mln tonnes, up +5.8% m-o-m and +75.9% y-o-y. April 2020 saw a decline to 4.2 mln tonnes, -15.3% m-o-m but still +63.4% y-o-y. In May 2020 the decline continued, with 3.7 mln tonnes, down -10.9% m-o-m, and now just +25.8% y-o-y. The numbers in June 2020 were terrible, with just 2.3 mln tonnes loaded, down -38.6% m-o-m and even down compared to last year, at -19.1% y-o-y”, the shipbroker noted.

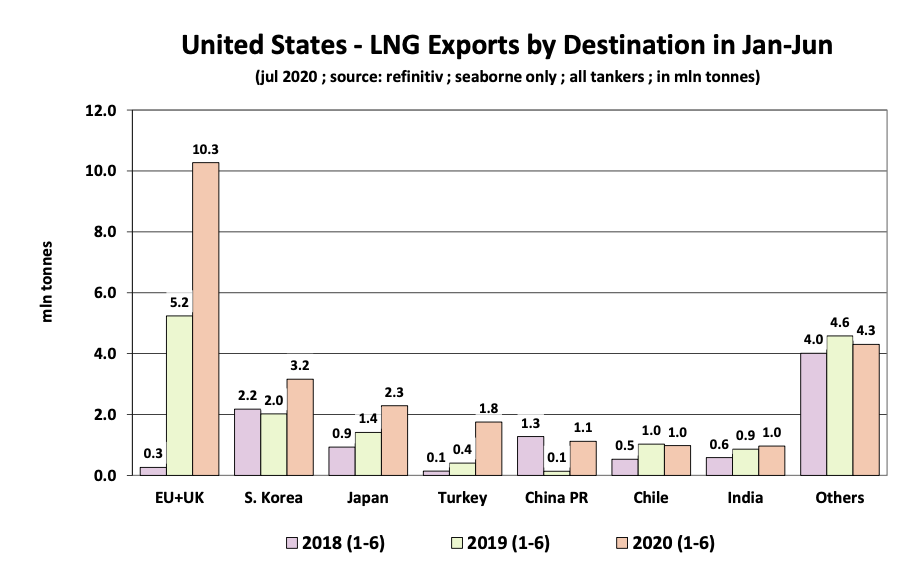

According to Banchero Costa, “the main destination for American LNG is still Europe. Of total exports in the first half of this year, 41.4% or 10.3 mln tonnes were destined for the European Union (including the UK). Volumes from the USA to Europe this year increased by +96.0% y-o-y from 5.2 mln tonnes in the same period of 2019. It’s worth noting that in the first half of 2018 volumes to Europe were as low as 0.3 mln tonnes. The second largest destination for USA gas is South Korea, which accounted for 12.7% of shipments so far this year. Volumes inceased by +56.4% y-o-y to 3.2 mln tonnes. In third place is Japan, with a 9.2% share. Shipments to Japan increased by +62.0% y-o-y to 2.3 mln tonnes. In fourth place is Turkey, which imported 1.8 mln tonnes of LNG from the USA in the first half of 2020, up +336% y-o-y from just 0.4 mln tonnes in the same period las year. Turkey now accounts for 7.1% of American LNG exports. Shipments to China bounced back to 1.1 mln tonnes, from a low of 0.1 mln tonnes in the first half of 2019, but we are still not back to the 1.3 mln tonnes recorded in the same period of 2018”, the shipbroker concluded.